Regarding VA home loans, the closing process generates more questions and confusion than any other part. And that’s understandable since there are so many moving pieces involved in a typical loan closing.

Today, we will address one of the most common questions related to VA loan closing. Many borrowers want to know can closing costs be included in a VA loan.

So, let’s start with the short version before digging into the details:

You can estimate your mortgage-related fees just by speaking to a lender. But they won’t be able to provide you with a detailed estimate until you have found a home.

Once you’ve identified the home you want to buy, the lender can provide an official “Loan Estimate” document detailing your VA loan closing costs. This will be followed by a finalized “Closing Disclosure” a few days before you are scheduled to close.

What is Closing Costs?

Before we move forward, it’s essential to understand closing costs. Closing costs are commonly referred to as the remaining charges and expenses incurred at finalizing the buying and selling of real estate.

The buyer and seller usually bear such fees, including the service provider’s costs and administrative work necessary for the property transaction’s completion.

Which begs the question: when will you find out what your closing costs will be on a VA loan?

A range of charges related to closing costs is lender fees, which are comprised of origination fees, points, and third-party fees for valuation, title search, and title insurance, among others.

On the other hand, closing costs will also include prepaid expenses, such as property taxes and homeowners insurance, and paying association dues – future payments to cover these costs.

For both the buyers and the sellers, knowledge, combined with budgeting for finishing costs, is vitally important as it may strongly influence the overall expenditures for a property.

How to Determine Your Closing Costs on a VA Loan

If you are eligible for a VA-guaranteed mortgage loan, you can buy a house with no down payment. This benefit eliminates one of the biggest hurdles to homeownership—the upfront expense.

However, you will likely encounter closing costs along the way, which can range from 2% to 5% of the base loan amount in most cases.

This begs the question: when will you determine your closing costs on a VA loan?

Therefore, this is a straightforward question with a somewhat complex answer that involves multiple steps. To simplify things, let’s break it down into three distinct stages of the loan process:

1. You can get an informal estimate from the lender upfront

Mortgage lenders that offer VA loans can provide you with an estimate of closing costs before you even apply. Lenders make loans so often that they have a pretty good idea of how much a borrower might pay in closing costs.

But this will only be a rough estimate. If you speak to a lender before you’ve found a house to purchase, they won’t know the exact loan amount, property value, and other important information.

So, at this stage, they won’t be able to offer an exact estimate of your VA loan closing costs rolled into loan. But they can give you a ballpark figure that might be helpful for planning purposes.

In addition to the loan estimate, you will get an Initial Disclosure Package containing several documents concerning the loan application. The document represents the entry point to the first lending phase and the cost margin for the loan provided by your creditors.

As part of this package, there will be a comprehensive overview of the loaning program, the rates of interest, the adjustment criteria, and the closing estimates. Going through these lets you discover and understand the detailed financial implications of your VA funding fee and its entire structure.

Furthermore, it creates a platform for inquiries and promotes transparency in the financing platform, thereby making the knowledge background you require as you prepare to become a homeowner.

2. You’ll receive a detailed Loan Estimate once you’ve found a home

You’ll get a clearer insight into your closing costs VA loan after you have found a home you want to purchase. At that point, your mortgage lender can provide you with an official “Loan Estimate” document.

Having taken the Loan Estimate, the next step is to review the terms and, if necessary, try renting it out to other lenders. One significant phase of the loan process is when you make borrowing decisions that empower you to get loan terms in your favor. In that situation, the closing costs may also be lower.

A Loan Estimate is a three-page form providing important information about the mortgage loan you’re considering. The Consumer Financial Protection Bureau (CFPB) created this document to help borrowers compare loan costs by standardizing how information is presented.

This is your first glimpse at your actual VA loan closing costs. But it’s not yet finalized. Sometimes, the amount a borrower pays at closing will be slightly different from the figure listed in their Loan Estimate.

To prepare this document, your mortgage lender will need (A) your name, income, and Social Security Number, (B) the address and value of the property you’re considering, and (B) the loan amount you’re seeking.

For this particular discussion, you can prepare an estimated loan amount with the hope of stimulating dialogue around unexplained or excessive fees or charges. Through negotiations, you can ask for amendments to the lending conditions, for example, the interest rates or origination fees, each of which influences the closing costs.

This document also provides other important information, including the loan amount, interest rate, and monthly payments. You can find an example online by searching “sample Loan Estimate PDF.”

Communicating with your lender at this stage will ensure that you are clear about all the financial terms of your VA loan, which will enable you to move on to the following stages of the process comfortably.

3. You’ll get a final Closing Disclosure shortly before closing

After receiving it, you will have three business days to examine the Closing Disclosure, and then you must close on the loan. Federal laws require this review period in order to provide borrowers enough time to comprehend the final terms of their loan and the closing fees associated with it.

It is crucial that you thoroughly review the Closing Disclosure over these three days to look for any differences or unanticipated cost adjustments. If you would want more information or clarification, don’t hesitate to get in touch with your lender.

With all the information about your VA loan closing expenses at your disposal during this waiting time, you can make an informed choice and go forward with confidence.

You’ll know more about your VA loan closing costs shortly before the day you are scheduled to close. That’s when you receive another official document known as the Closing Disclosure. Moreover, you can use the VA loan closing costs calculator to determine the value of your disclosure.

The Closing Disclosure is a finalized version of the initial Loan Estimate that provides additional information. This five-page document contains the finalized terms and costs of the mortgage loan, including the actual interest rate, monthly payments, and closing costs.

The Closing Disclosure will also show any adjustments to the terms since the Loan Estimate was provided. This allows you to review the final costs and terms to ensure they align with what was initially presented.

In a typical home-buying scenario, borrowers using VA loans will receive their Closing Disclosure a few days before closing. This gives you time to prepare your payment method, usually as a cashier’s check or wire transfer.

The Closing Disclosure also contains a financial summary of the real estate transaction, along with contact information for the lender, real estate agent, and other parties involved. So keep it securely, ideally in a safe deposit box.

Asking Questions at Seeking Clarification

We’ve only scratched the surface here when it comes to the documents and disclosures associated with a VA loan. Throughout your home-buying journey, you must review and sign a wide range of documents.

Be sure to ask plenty of questions so that you understand what these documents contain and how they relate to your VA loan. You should never feel like you’re bugging someone by asking many questions.

Reputable mortgage lenders and escrow companies should take all the time they need to answer your questions and help you understand the process.

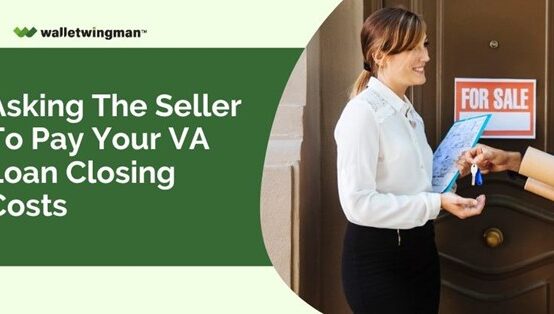

Asking the Seller to Pay Your VA Loan Closing Costs

Asking the Seller to Pay Your VA Loan Closing Costs  6 Ways to Prepare for Closing When Using a VA Loan

6 Ways to Prepare for Closing When Using a VA Loan