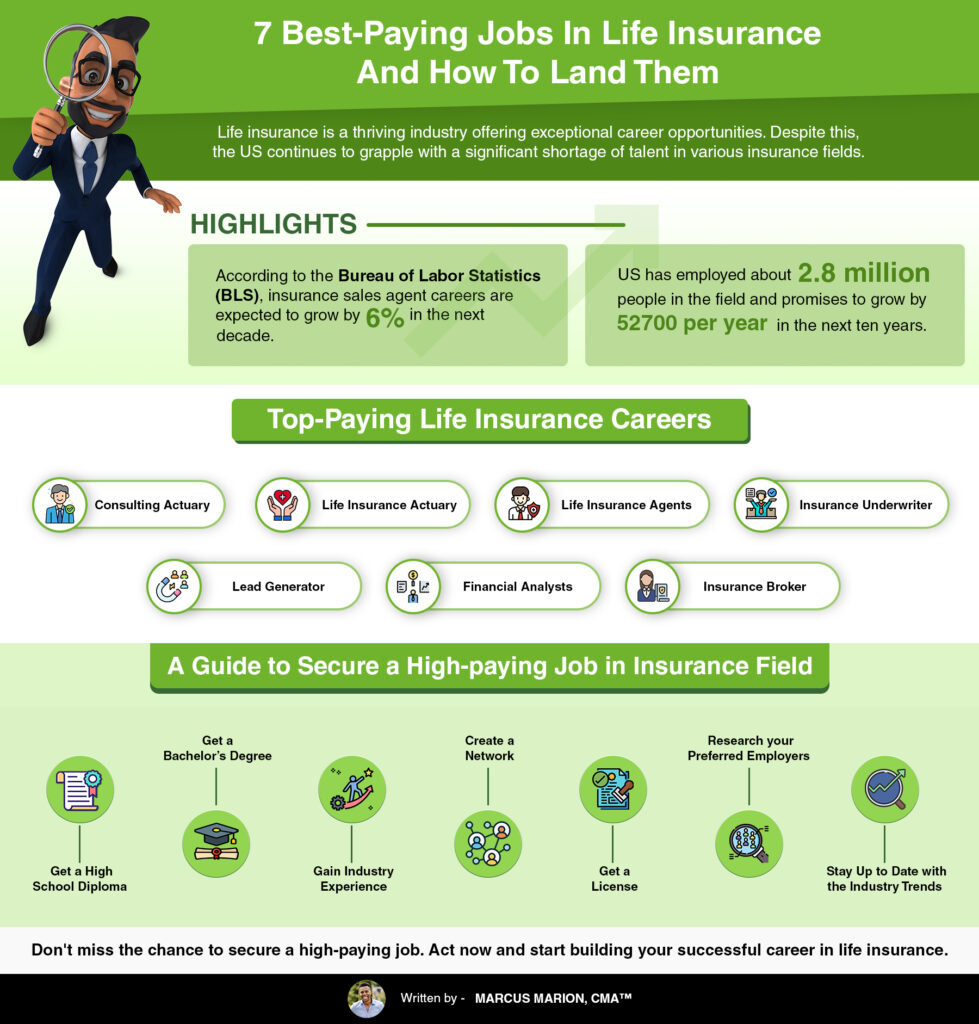

Life insurance is an extensive industry with excellent career opportunities. Despite this, the US continues to face a significant shortage in talent acquisition in the various insurance fields. Let’s explore the life insurance jobs in this field.

Stats by the US Bureau of Labor Statistics (BLS) highlight that there will be a 6% growth in insurance sales agents’ careers in the next decade, which is about as fast as the average growth rate of all the other jobs in insurance companies.

In addition, the US has employed about 2.8 million people in the field and promises to grow by 52700 per year in the next ten years. This shows why now is the best time to venture into this field and be part of its growth.

However, like other industries, no two insurance jobs match; the careers are broadly varied, which makes it inevitable to have the best-paying jobs in life insurance. Nonetheless, the field has many positions for all categories, from entry-level to intermediate to professional roles. Let’s dive in and explore the best-paying jobs in life insurance, along with some tips on securing a position in this field.

7 Best Paying Jobs in Life Insurance

The average pay for an ordinary occupation in life insurance is $52180 per year, data by the US Bureau of Labor Statistics. Here’s a list of the highest-paying insurance jobs:

1. Consulting Actuary

You can be a perfect match for a consulting actuary career if you possess deep analytical, statistics, and mathematics concepts. Consulting actuaries enhance analytical skills to provide clients with risk assessment and accounting advice. This position often requires a good portion of experience in risk modeling and obtaining financial audits to aid in analytical decisions.

Actuarial consultants make money by partnering as independent contractors or freelancers or as partners with large consulting agencies. The average salary of a consulting actuary ranges from $94000 to $174000 in the year.

2. Life Insurance Actuary

People who pursue this line generate relevant and up-to-date reports on sales and management, analyze finances, and assess risks. Insurance companies depend on their services to reduce risks arising from poor analytical skills, which can lead to increased operating costs. To succeed in a life insurance actuary role, possess good communication and analytical abilities.

Understanding complex information regarding an insurance company’s operations is paramount to fit in the typical life insurance actuary positions.

Furthermore, knowledge of human psychology is critical to identify the client’s patterns and trends and develop accurate data that allows for better decision-making and money cost saving. The average salary for a life insurance actuary is $111040 per year.

3. Life Insurance Agents

Agents’ primary role involves reaching out to potential customers, companies, and individuals and convincing them to subscribe to a particular insurance policy. Simple as it sounds, you could ask, “Is selling life insurance a good job?” “Is it worth it, and could it promise good pay?”.

Professionals in this field are characterized by multiple roles, increasing their earning capacity through various ways, including basic salaries and commissions.

Other roles of life insurance agents include pitching policies, providing charge estimates, issuing information, and responding to client queries. A life insurance agent can earn up to $79730.

4. Insurance Underwriter

An insurance underwriter, also called an underwriting manager, is one of the highest-paying jobs you can undertake. Insurance underwriters oversee administrative tasks and daily operations of a company’s underwriting department.

Professionals in this line are responsible for reviewing applications, developing methodologies, assessing clients’ financial risks, establishing screening protocols, and managing team development.

Based on its nature, the role isn’t suitable if you’re up for taking pride in organization skills or making tough decisions in the life insurance field. With this role, you can make a $103195 salary on average, which is way beyond what average employees earn.

5. Lead Generator

As the name suggests, lead generators employ their influence capabilities to bring potential leads to insurance companies through email campaigns, direct mail, and online marketing. Generally, lead generators are paid for each successful lead generated. However, the amount depends on the exclusivity and quality of the lead itself.

Interestingly, besides being a lucrative job with life insurance, you don’t need any special qualifications to start a lead generator career. This could be your ideal job if you’ve got some lead generation experience and basic life insurance dynamics knowledge.

The pay for this role can widely vary due to its earning model, which involves pay per lead. Nonetheless, a single lead could earn you up to $50.

6. Financial Analysts

What do insurance companies do with the premiums and payments from clients? Insurance companies are typically institutional investors and invest these revenues into equities and bonds to yield returns and help in the company’s operation.

As such, companies need financial advisors who can analyze viable investment opportunities to better invest finances before investing in any form.

And that’s where financial analysts come in. Like risk specialists, being a financial analyst, you help insurance companies make decisions that can result in maximum return on investment (ROI) after investing. A role as a financial analyst requires a minimum degree of education in business or a related field. You can earn up to $95750 per year as a financial analyst.

7. Insurance Broker

Last on our list of the best-paying jobs in life insurance is the insurance broker. The role of an insurance broker involves connecting customers with a best-fit policy by gathering information, then recommending a policy.

Some prefer specializing in a particular policy and insurance, while others shop for quotes from different companies and then explain the various features to the clients in detail.

Setting foot in this job is often easier because possessing a college degree is not a condition. Nonetheless, a broker’s license is preferred. The average pay for an insurance broker is $88475.

Tips on Securing a High-paying Job in the Life Insurance Field

As promised, here is some practical information to have with you so that you can win a lucrative and high-paying job in the life insurance industry.

1. Get a High School Diploma

While many insurance jobs call for a college degree as the minimum education, you can also secure an entry-level position with a high school diploma. This allows you to study the industry dynamics in all stages, giving you a better chance to thrive and make a profitable career in the future.

With strong interpersonal, sales, and communication skills plus a high school diploma certification, you can get started with various insurance sales positions.

2. Get a Bachelor’s Degree

If you want to explore a life insurance job focusing on business, analytical, marketing, and mathematics concepts, consider investing in a related degree. Potential degrees that can position you to land a high-paying insurance job include Finance, marketing, accounting, mathematics, business, or related.

Additionally, pursuing professional certifications such as the Fellow of the Society of Actuaries (FSA), Chartered Life Underwriter (CLU), or Certified Insurance Counselor (CIC) can enhance your credibility and job prospects in the industry.

3. Gain Industry Experience

You could opt for an entry-level job in insurance, which requires little to no experience. However, it’s a mandatory requirement by many employers to possess some industry working experience and knowledge of how insurances operate to secure a senior-level or associate position.

You can apply for a sales representative or administrative assistant, among other entry jobs or internships, to succeed. This way, you’ll gain the required experience and ultimately, in the end, secure a job with life insurance.

4. Create a Network

Networking is an invaluable tool for securing a job in the life insurance industry. By networking with people in the industry and asking for any opportunities, you open paths for interviews, referrals, and internships.

To build a network, consider joining professional insurance organizations offline or online and make your presence known. Simple online research can suggest whether there are local meetups for people in the life insurance industry.

In addition, networking could connect you with hiring managers, mentors, and industry experts who educate you on the trends and patterns alongside practical tips to aid your career growth and self-improvement.

5. Get a License

While it’s not a must to own any particular specifications or degree for most agencies, an insurance license is a catalyst to landing one of the best-paying jobs in life insurance. Some companies can work with you while you wait for license issuance, but others call for it before onboarding you.

6. Research your Preferred Employers

It’s good to realize that all insurance agencies differ in commission, salary, and benefits. Thus, subject to your salary and other benefits expectations, you must conduct thorough research to ensure you set foot in the right place. Besides, based on your experience level, you could get a perfect fit employer after researching.

7. Stay Up to Date with the Industry Trends

Lastly, realize that the life insurance industry is constantly evolving due to regulation changes, shifts in customer preferences, and technological growth. As such, ensure you’re always ahead of the prevailing updates and trends to remain relevant and competitive in the industry.

Subscribe to life insurance publications, follow thought leaders on social media, and participate in workshops and webinars. Ultimately, you’ll be a desirable candidate for a good insurance job.

Summary

Explore the diverse career paths available in the life insurance industry today, ranging from entry-level roles to senior-level management positions. Don’t miss out on the opportunity to secure a well-paying job. Take action now and start building your successful career in life insurance.

Pros And Cons Of Pet Insurance: A Comprehensive Analysis

Pros And Cons Of Pet Insurance: A Comprehensive Analysis  10 Highest-Paying Life Insurance Jobs You Can Consider In 2023

10 Highest-Paying Life Insurance Jobs You Can Consider In 2023