The VA loan program offers a lot of unique benefits for eligible borrowers. This program, mainly reserved for military members and veterans, allows borrowers to purchase a home with no down payment.

Even when choosing a zero-down payment option, the VA loan program enables you to avoid paying private mortgage insurance, or PMI, which several borrowers aren’t even aware of.

In this article, you’ll learn what private mortgage insurance is and how you could avoid paying it by using a VA loan to buy a house.

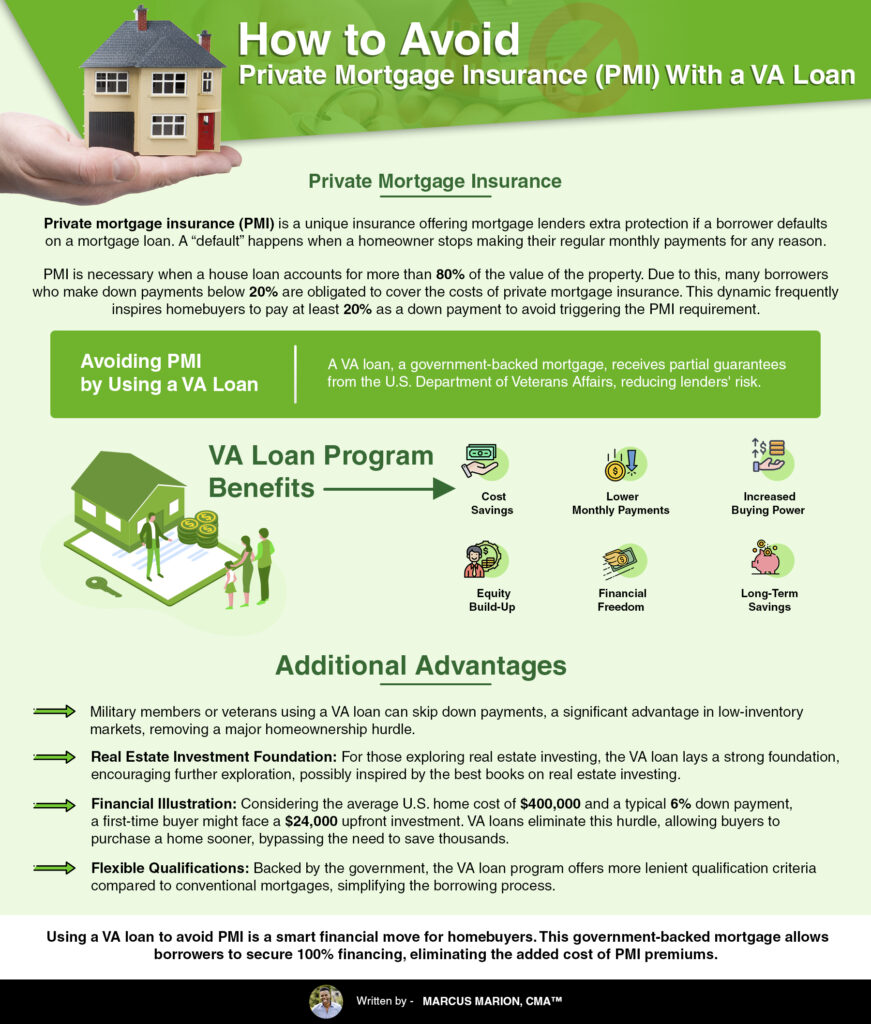

What Is Private Mortgage Insurance?

Private mortgage insurance (PMI) is a unique insurance offering mortgage lenders extra protection if a borrower defaults on a mortgage loan. A “default” happens when a homeowner stops making their regular monthly payments for any reason.

Normally, PMI is necessary when a house loan accounts for more than 80% of the value of the property. Due to this, many borrowers who make down payments below 20% are obligated to cover the costs of private mortgage insurance. This dynamic frequently inspires homebuyers to pay at least 20% as a down payment to avoid triggering the PMI requirement.

A monthly premium is frequently paid for PMI in addition to the borrower’s mortgage payment. Consequently, it increases the size of those payments, possibly by several hundred dollars per month.

The ability to acquire a property sooner rather than later with a lower initial expenditure is a noteworthy benefit of private mortgage insurance. However, the prevalent trend of 3% to 5% down payments may diminish in the absence of PMI, particularly amid a shortage of inventory.

Avoiding PMI by Using a VA Loan

Everything discussed in the previous section pertains specifically to conventional mortgage loans. The absence of federal government insurance or guarantee distinguishes a conventional home loan.

A VA loan, on the other hand, is a kind of government-backed mortgage. To lower the risk involved with mortgage loans, the U.S. Department of Veterans Affairs grants partial guarantees to lenders.

As a result, VA loans tend to be more flexible and lenient compared to conventional mortgage financing. Even with little or no down payment, home buyers who use a VA loan can avoid paying mortgage insurance.

This can be a potential game-changing opportunity for some buyers, particularly those with an inventory deficit, as they navigate their upfront purchase expenses. With a VA loan, a borrower can cover all or part of the purchase price without paying the extra mortgage insurance fee.

The official VA website has an article entitled “Ten Things Most Veterans Don’t Know About VA Home Loans.” Here’s what it says about VA loan PMI:

“With a VA loan, you also avoid steep mortgage insurance fees. At 5 percent down, private mortgage insurance (PMI) costs $150 per month on a $250,000 home, according to PMI provider MGIC. With a VA loan, this buyer could afford a home worth $30,000 more with the same monthly payment, simply by eliminating PMI. Using a VA loan saves you money upfront, and tremendously increases your buying power.”

How It Benefits Home Buyers

In summary, using VA loans for home purchases allows borrowers to avoid private mortgage insurance (PMI). This benefit offers several clear advantages as follows:

- Cost Savings: Borrowers save money by not having to pay monthly mortgage insurance premiums, which could significantly reduce their overall monthly housing expenses.

- Lower Monthly Payments: With a VA loan, the borrower’s monthly mortgage payments would likely be lower than with a conventional loan with PMI. This helps to make homeownership more affordable in case of inventory scarcity.

- Increased Buying Power: By taking mortgage insurance out of the picture, borrowers might be able to qualify for a larger loan amount. This, in turn, would allow them to purchase a more expensive property.

- Equity Build-Up: Without mortgage insurance eating into their payments, borrowers can build equity in their homes more quickly. This scenario speeds up wealth-building for homeowners and opens doors to exploring how to invest in real estate without buying property, as increased equity can be used for various opportunities.

- Financial Freedom: Avoiding mortgage insurance also gives borrowers greater financial stability and control over their housing expenses, creating a stronger overall financial situation.

- Long-Term Savings: Over the life of the loan, the savings from not paying mortgage insurance can add up to thousands of dollars.

Other Benefits Offered by This Program

As you can see, this is an undeniably compelling benefit. There’s no other program that allows you to finance 100% of the purchase price while avoiding any form of mortgage insurance. That’s one of several things that make the VA loan program unique and rewarding.

But it’s not the only benefit. Here are some of the other advantages this program offers.

As mentioned above, a military member or veteran who uses a VA loan to purchase a home could do so without making a down payment. So, this program basically eliminates one of the biggest hurdles to homeownership, a particularly significant advantage in real estate markets marked by low inventory levels.

For those interested in delving further into real estate investing, it lays a strong foundation, possibly inspiring them to explore some of the best books on real estate investing.

Here are some numbers to help illustrate this point:

Currently, the average cost of a home in the United States is about $400,000. As per the National Association of Realtors, the typical down payment for first-time home purchasers is about 6%. Using those numbers, a first-time buyer purchasing a median-priced home might end up with a down payment of around $24,000.

That’s a lot of money to save, and it shows why some buyers have a hard time coming up with a down payment in the first place.

However, a VA loan can only be used to finance the full amount of the purchase price. This allows them to buy a home much sooner since they don’t have to save thousands of dollars for that upfront investment. This approach eliminates the time-consuming process of figuring out how to save money to buy a house, ultimately expediting the path to homeownership.

The VA loan program also offers flexible qualification criteria when compared to conventional mortgage loans. Due to government backing, mortgage lenders can offer more flexible criteria for borrowers. As a result, the VA loan program is one of the simplest forms of mortgage loans to receive.

Conclusion

Leveraging a VA loan to steer clear of Private Mortgage Insurance (PMI) is a powerful financial strategy for homebuyers.

By embracing this government-backed mortgage option, borrowers can not only secure 100% financing for their home purchase but also avoid the added expense of PMI premiums.

The VA loan program’s unique and rewarding features exemplify the nation’s commitment to supporting its military personnel, enabling them to achieve their homeownership dreams with greater ease and financial security.

You Don’t Need a Home Inspection to Get a VA Loan, However…

You Don’t Need a Home Inspection to Get a VA Loan, However…  How to Buy Your First Home During an Inventory Shortage

How to Buy Your First Home During an Inventory Shortage