Over the past few years, the real estate market in the United States has seen many ups and downs.

During the epidemic, it accelerated due to the relocation and property purchases of countless Americans. In 2022, when mortgage rates more than doubled, it began to cool. And as we go towards the second half of 2023, things seem to heat back up.

Home buyers around the United States are feeling a little confused and hesitant due to the rapid changes over the last three years. Many people are already thinking about 2024 and debating whether it would be wise to invest in American real estate during that year.

This article will examine historical, present, and (perhaps) future housing market conditions to answer this commonly posed question: Should I buy a house now or wait till 2024?

What Is a ‘Good’ Time to Buy a Home?

What does it mean when people say it’s a “good” or “bad” time to buy a home?

How do we apply labels to something as vast, diverse, and complex as the U.S. real estate market?

To determine if it’s the best time of the year to buy a house, a person should consider various factors, including:

- Personal financial situation and affordability

- Job stability and future income prospects

- Long-term commitment to the area

- Interest rates and mortgage options

- Local housing market conditions

- Housing inventory and competitive buyer landscape

- Requirements for future housing and changes in lifestyle

- The likelihood of rising property values

- Outlook of the nationwide economy and analyzing marketing trends

The market-related topics covered in the following sections of this article include mortgage rates, property values, housing supply, and potential changes in the real estate market in 2024.

Prices Expected to Rise Again

Homes were more expensive after the Covid-19 outbreak in several American cities. During this time, which lasted until the middle of 2022, prices peaked. Following that, property values started to decline in some American cities due to the market’s following self-correction.

Nonetheless, property values have started climbing again in several parts of the United States. Overall, forecasters believe home prices will go up again, but this time, the rise will be moderate and consistent with earlier long-term trends.

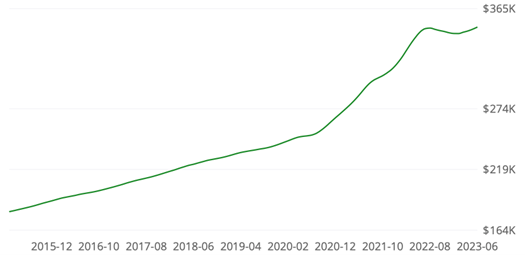

The graph below from Zillow shows the median cost of homes in the U.S. during a period of more than 10 years. There is little doubt that the outbreak contributed to prices increasing more swiftly in late 2020. At that time, a large number of people were purchasing homes and moving to other areas; therefore, an unexpected increase happened.

The graph also demonstrates that costs peaked in 2022 before restarting in 2023 after a brief pause. Numerous towns and communities around the nation have noted the same trend.

According to recent predictions, real estate prices are expected to increase through the end of this year and into 2023. For instance, a dependable source, Zillow, forecasted that property prices in the United States may increase by about 6% between June 2023 and June 2024.

Similarly, in July, CoreLogic, a housing data and analytics business, predicted:

When comparing home prices month-to-month from May 2023 to June 2023, the CoreLogic HPI Forecast anticipates a 1% gain. Additionally, when comparing May 2023 to May 2024, housing prices are expected to increase by 4.5% yearly.

What does this mean for those looking to buy a property, then? And how does it relate to the question we started with: Will 2024 be a good year to buy a home?

From a buyer’s perspective, the ideal scenario is to purchase a home when the market is near the end of a downturn and then enjoy positive price growth going forward. Real estate professionals often refer to this strategy as “buying at the bottom” of the market.

And we seem to be at a point where people have an opportunity to do exactly that through the second half of 2023 and perhaps into early 2024.

Mortgage Rate Trends and Outlook

Of course, home prices aren’t the only consideration when buying a home. Most buyers use mortgage loans to help finance their purchases, which brings the topic of mortgage rates into the discussion.

A 30-year fixed mortgage loan’s average rate increased from 3.22% at the beginning of 2022 to a peak of 7.08% by November of that year. This contributed to the overall market cooldown mentioned earlier.

Since then, rates have eased a bit and are hovering within the upper 6% range.

The Mortgage Bankers Association recently predicted that 30-year mortgage rates would decline gradually over the coming months and average in the mid-5% range for much of 2024.

Granted, that’s just a forecast — not a certainty, and it does raise the question, “Should I buy a house now or wait until 2024?”. Most forecasters seem to agree that another spike in mortgage rates appears unlikely, at least for the foreseeable future.

Inventory and Competition Factors

Last but certainly not least, we come to the housing market inventory situation. This has been the big story in the real estate sector for several years.

In most housing markets across the U.S., supply levels were already well below historical norms before the pandemic started. And they only sank lower as COVID shifted the housing market into overdrive.

Inventory levels rose during 2022 but have trended downward again over the past few months. The bottom line is that there still aren’t enough homes for sale to meet the requirements of buyers, at least in most parts of the country.

Home buyers who plan to purchase later this year or early 2024 should be prepared for stiff competition. Unless something significant changes on the supply front, the market will remain competitive as buyers seek to outmaneuver one another.

Conclusion

The question of whether 2024 presents a favorable condition to buy a home is multi-faceted, looking at the dynamic landscape of the U.S. real estate market.

The recent ups and downs in the market, caused by the pandemic’s impact, have made the decision-making process more complex. Although home prices are expected to rise moderately, aligning with historical trends, U.S. housing market predictions remain challenging.

Before arriving at a decision, prospective buyers must carefully keep in mind factors like financial preparedness, long-term objectives, and the current market dynamics.

Teaming up with knowledgeable professionals and staying well-informed will be crucial to navigating the uncertainties of the 2024 real estate landscape.